by David Haverstick | Nov 30, 2018

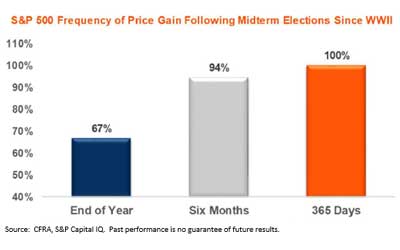

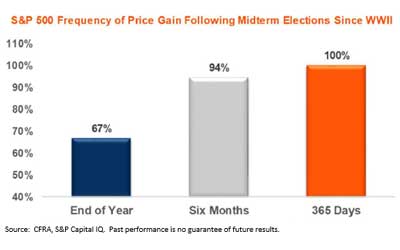

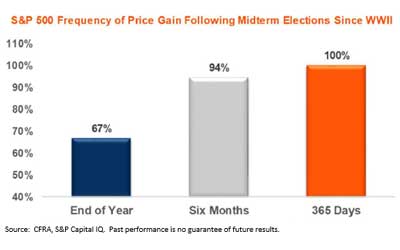

The highly debated midterm elections have come and gone. After the dust settled, Congress is split as the Democrats secured enough seats to flip the majority and retake the House while the Republicans added seats to their majority in the Senate. Let’s take a look...

by David Haverstick | Sep 28, 2018

One important note to distinguish us at Ables, Iannone, Moore & Associates from other firms is we use individual stocks and bonds. This helps us manage portfolios with tremendous flexibility, control and transparency. It also allows us to reduce costs. We believe...

by David Haverstick | Sep 7, 2018

This is literally a question we get asked all the time, regardless of the market environment. It is understandable – not all portfolios are created equal regarding entry price and allocation – and people come to us at differing times with new money or cash positions...

by Jeff Iannone | Apr 28, 2016

This rule has been hotly debated over the past several months and although it can impact many individuals, many individual investors don’t seem to care or want to know the details. Frankly, that is understandable as so much in the financial sector is a bit ‘cloudy’...

by Jeff Iannone | Mar 30, 2016

Despite the stock market’s decline this year this is not the time to panic. Instead, take advantage of the markets. Here are a few thoughts that may be beneficial.Convert all or a portion of your traditional IRA to a Roth IRA.IRA’s grow tax deferred, where Roth IRAs...

by Jeff Iannone | Feb 15, 2015

Thank you to my friend Randy Gipson who sent me this article from Forbes, Inc. I am reposting this as I think it provides excellent insight into the real costs of using funds versus utilizing individual stocks and bonds and it illustrates some of the many reasons we...