by David Haverstick | Apr 20, 2021

In our most recent newsletter, we covered the great inflation debate that began during the first quarter of 2021. Inflation fears triggered a pronounced rotation out of growth stocks and into value stocks. We wanted to expand the conversation over here on the blog...

by David Haverstick | Jun 22, 2020

Earlier this week, the IRS made some adjustments to the required minimum distribution (RMD) rules for 2020. First, some background. With the passage of the SECURE ACT, an RMD for 2020 is no longer required. But what if you had already taken your RMD? Can you put...

by David Haverstick | Dec 20, 2019

If you are one of the 44 million borrowers saddled with student loan debt, it can be a heavy burden to carry. According to Forbes, student loan debt is the highest it has ever been at more than $1.5 trillion. That ranks second, behind only mortgage debt, as the...

by Jeff Iannone | Apr 8, 2019

We are not tax advisors, but over the past few months a clear trend has developed during our conversations with clients and income tax professionals – The new higher standard deductions have made charitable contributions less beneficial and often non-deductible.In...

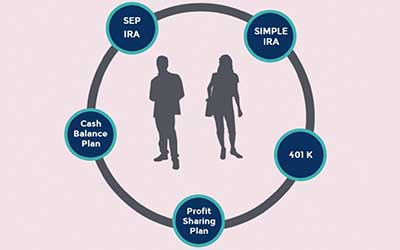

by David Haverstick | Mar 30, 2019

This time of the year brings a myriad of questions surrounding retirement plans for the self-employed and the business owner. Whether you are a sole proprietor, small business owner, medical practice or larger corporation, retirement plans are essential tools for tax...

by David Haverstick | Mar 28, 2019

We need to talk about Nevada, where leading broker-dealers including Morgan Stanley, Edward Jones, Charles Schwab, Wells Fargo and TD Ameritrade have sent letters to the state threatening to stop doing business or reduce investment services for investors if a...