Market Update – Second Quarter, 2025

HERE IS WHAT WE KNOW. The Trump administration has been clear about what they want – a lower deficit, lower dollar, lower oil and lower long-end treasury rates. The administration also wants to keep tax cuts in place, and they want the Fed to lower the fed funds rate. There isn’t too much debate about that set-up being a pro-growth environment. The challenge is the administration can’t simply pull these levers lower in unison. It doesn’t work that way. What the administration has chosen to do, however, is put policy in place to force some combination of their desired outcomes. That policy has focused on DOGE, de-regulation and in case you’ve somehow missed what the entire world is talking about – increased tariffs.

Tariffs are a complicated topic. In simple terms, tariffs are a tax on imported goods from producers abroad – a tax to access the U.S. market and consumer. The complexity of tariffs quickly ramps up because their success or failure depends on many interrelated factors such as how long will the tariffs be in place? Are there negotiations that reduce or eliminate the tariffs? Will countries retaliate or escalate their own tariff policies? How will foreign producers adjust margins? How much of the tariff will pass through to the end consumer? How will FX (currency) adjustments play into the equation? And maybe most importantly, how will elasticities of demand impact product substitution, inventories and consumption? It’s too early to know the answers but the answers matter greatly because they will ultimately define the new equilibrium of global commerce.

Here is more of what we know – a stock’s value is derived from the estimated future cash flows of the company AND the risk to those cash flows. At the announced U.S. and global tariff levels, cash flows will take a substantial hit and therefore equity markets won’t wait around to see who wins this global tariff game of thrones – this is why stocks have gotten crushed in the last week.

To put the U.S. equity selloff in context, we’ll highlight a Wall Street Journal article citing Deutsche Bank strategists who stated there have only been three other times since WWII the S&P 500 (or equivalent index) dropped 10% or more in a two-day span. The S&P 500 fell 10.5% last Thursday and Friday joining March 2020 (Covid), November 2008 (Global Financial Crisis), and October 1987 (Black Monday crash).

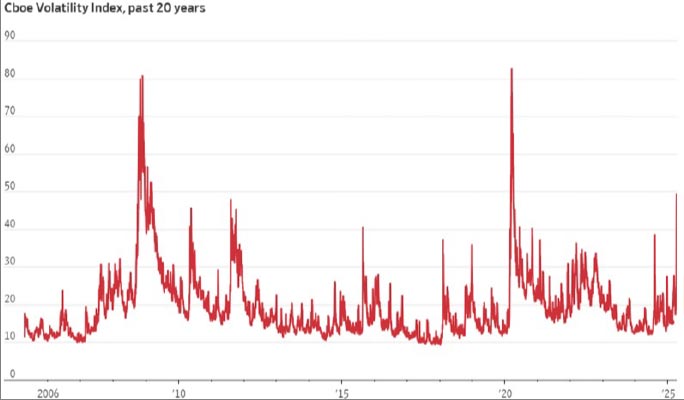

The Volatility Index (VIX) also shows the extreme uncertainty in equity markets. At the time of this writing the VIX is at 50, having spiked up over 60 in earlier trading. Caitlin McCabe from the Wall Street Journal writes, “there have only been two periods in the last two decades when the gauge has ended the day above 50: late 2008 and early 2009, during the trough of the global financial crisis; and early 2020, during the coronavirus-induced market selloff.” The chart below shows the volatility index over the past 20 years.

AIMA, Inc.

419 Montgomery St.

Savannah, GA 31401

Phone: (912) 777-4128

Fax: (912) 777-5943

AIMA, Inc.

419 Montgomery St.

Savannah, GA 31401

Phone: (912) 777-4128

Toll Free: (866) 815-6004

Fax: (912) 777-5943

AIMA, Inc. Form ADV, Part 2A & Relationship Summary

Investment Advisory Services are offered through Ables, Iannone, Moore & Associates, Inc., a Registered Investment Advisor. This website is designed to service our fee-only investment advisory clients and investment advisory prospects. Ables, Iannone, Moore & Associates, Inc. is an independent Registered Investment Advisor.

© 2014-2025 Ables, Iannone, Moore & Associates, Inc.

AIMA, Inc. Form ADV, Part 2A & Relationship Summary

Investment Advisory Services are offered through Ables, Iannone, Moore & Associates, Inc., a Registered Investment Advisor. This website is designed to service our fee-only investment advisory clients and investment advisory prospects. Ables, Iannone, Moore & Associates, Inc. is an independent Registered Investment Advisor.

© 2014-2025 Ables, Iannone, Moore & Associates, Inc.

Privacy Policy | Terms & Conditions