The highly debated midterm elections have come and gone. After the dust settled, Congress is split as the Democrats secured enough seats to flip the majority and retake the House while the Republicans added seats to their majority in the Senate. Let’s take a look under the hood, courtesy of our friends at CFRA Research, and see what history tells us about post-elections, political gridlock and market returns.

The highly debated midterm elections have come and gone. After the dust settled, Congress is split as the Democrats secured enough seats to flip the majority and retake the House while the Republicans added seats to their majority in the Senate. Let’s take a look under the hood, courtesy of our friends at CFRA Research, and see what history tells us about post-elections, political gridlock and market returns.

This was the 19th midterm election since 1946.

Did you know?

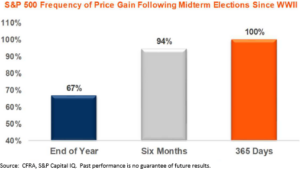

- From election day to the end of the year, the S&P 500 has averaged a 3.3% gain and it has advanced 67% of the time.

- Looking at the six months after the election, the S&P 500 has advanced 13.8% on average and did so 94% of the time.

- Going out a year after the election, the average price gain in the S&P 500 was 14.5% and it advanced 100% of the time.

History is only a guide, not a guarantee, but what stands out most to us is the 100% advance rate in the 365 days after the election in comparison to only 2/3rds of the time in the short timeframe up to year’s end. Clearly, investors become more and more bullish once the midterm elections pass. A large part of that bullishness can be credited to the fact that the uncertainty leading up to the election is now minimized, if not gone entirely. Will it happen again after this midterm election, in this environment? That is the million-dollar question, as the saying goes. The actual legislative environment does matter so let’s dig even deeper and see what history tells us about political gridlock.

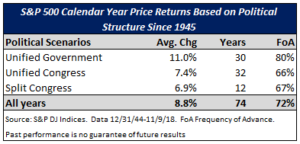

- Since WWII, the best market returns as measured by the S&P 500 occurred when the Government was unified. In other words, the President and controlling majority in Congress were from the same party.

- The second-best scenario for the S&P 500 occurred when Congress was unified but the President was from the other party.

- The third-best scenario overall for the S&P 500 occurred with a split Congress.

The Unified Government scenario is by far the best and it makes clear sense because there is little need for compromise to get legislation and policies approved. The 80% frequency of advance is the telling number in that scenario. Under a Unified Congress, there is still room to approve stimulus and policy, albeit with a bit of compromise. The least favorable set-up is a Split Congress because both sides typically dig their heels in and all but refuse to compromise. We believe volatility and returns will be influenced by how Congress decides to govern. The President will likely focus in on key areas where his executive powers can be maximized such as tariffs. Other legislative items such as immigration, further tax overhauls and healthcare reform will likely face stiff headwinds.

It is important to remember that markets are a reflection of several variables, domestic politics being just one of those inputs. We believe a couple of the challenges facing this market are very real but controllable, namely tariffs and Fed monetary policy. A healthy skepticism is welcomed as we progress forward under a split Congress, in this global economic environment at this stage of the corporate earnings cycle. However, on balance we believe history has written a strong case for continued market gains post midterms. We take a wide-angle view and understand this is not the first-time investors have differed on politics or faced trade wars, inflation or rising interest rates. The short-term view isn’t always the clearest one so we must continue to invest with the long-term in mind.