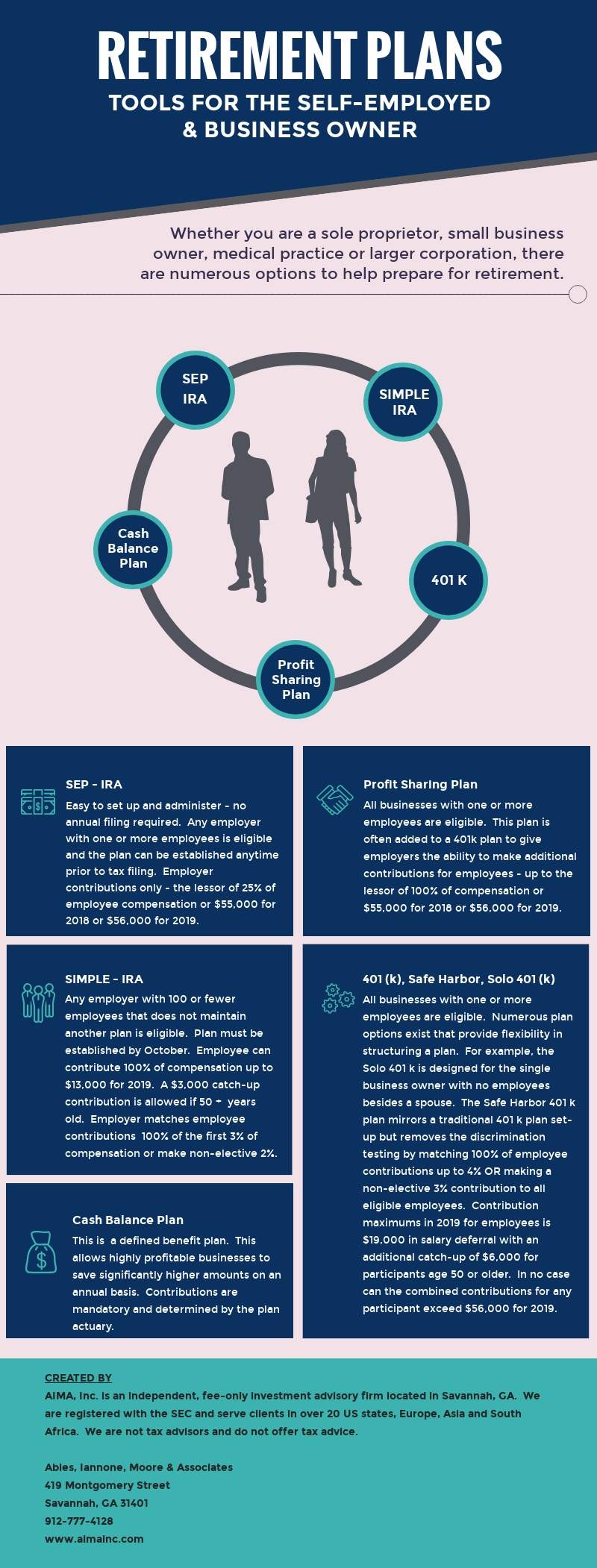

This time of the year brings a myriad of questions surrounding retirement plans for the self-employed and the business owner. Whether you are a sole proprietor, small business owner, medical practice or larger corporation, retirement plans are essential tools for tax and retirement savings. We understand every business is different and welcome the opportunity to discuss your needs and help design a plan that makes sense. If you currently have a plan in place and would like to review it, we would be more than happy to look at it with you. In the end, there are few tools more powerful than retirement plans for the business owner – they can create annual tax savings, provide tax deferred growth to fund retirement and if applicable, aide in the recruiting and retention of employees.